If you are planning for retirement and have an eligible spouse, the pension option you choose is important as it will determine the amount of pension paid to your surviving spouse after you die.

You must select your pension option when you complete the retirement application and before you start receiving your pension.

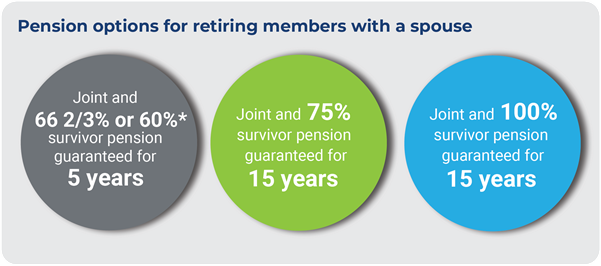

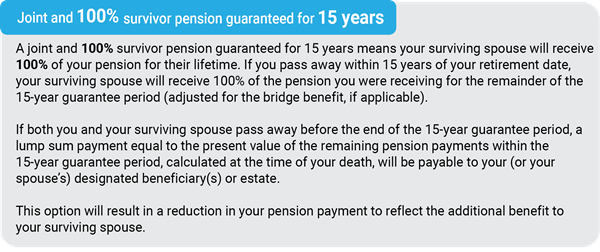

If you have a spouse at retirement, a joint and survivor pension ensures that they receive a portion of your monthly pension for the remainder of their life.

If you do not have a spouse at retirement, you will be provided with a Lifetime pension guaranteed for 15 years.

If you pass away before receiving 15 years (180 months) of pension payments, your designated beneficiary(s) or estate will receive a lump sum payment equal to the present value of the remaining pension payments within the 15-year guarantee period, at the time of your death.

Additional Information

Spousal Relationship Changes

Learn about Spousal Relationship Changes and your pension.